Stuart Wright

Well-known member

We're not having difficulties with our accounting software. I'm not sure it would necessarily break other peoples' systems if eCommerce were to start sending the correct tax information to PayPal.What you have to understand is that when it comes to people's actual money, I can't simply make potentially breaking changes because one or two people have difficulties with their accounting software.

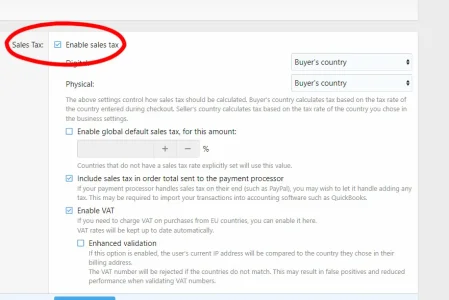

Sure and I apologise for being too strident. I'll be the first to admit that I'm not familiar with payment systems and I'm the last person who wants to be. It's bloody boring! So I could have some option set incorrectly somewhere. What I need, though, is to charge VAT and the PayPal invoice to show that. Is that possible?I think you'll also be forced to agree that blanket statements such as "conforming to proper financial accounting requirements" aren't exactly the most neutral statements possible

First of all, I think most eCommerce users will not be VAT registered.eCommerce has conformed to proper financial accounting requirements for 5+ years. That is as long as I have been running it for DBTech, and I have never heard any complaints from either my accountant or HMRC.

But for those who are, I wouldn't be at all surprised if all of them are just ignoring the VAT on digital sales through eCommerce and flying under the tax radar.

Unless I've got an option wrong somewhere to send the tax figure through to PayPal.