HeBeLe

New member

@DragonByte Tech, I'm having the same problem.I have an error while upgrading:

@DragonByte Tech, I'm having the same problem.I have an error while upgrading:

I have an error while upgrading:

I've applied a hotfix that should resolve the problem. Re-download a fresh copy and use the archive installer to import it.@DragonByte Tech, I'm having the same problem.

This is not a Classifieds addon, sorry.Does this allow user to sell product?

You cannot buy your own products. Reassign the products to a company account or something, like I do @ DBTechI noticed when I add a digital product that the purchase button doesn't show for me. When I log out the button shows. Is this normal or do I need to do something?

You can disable the VAT system via the AdminCP, if you don’t need it.Perhaps I missed the setting but I think it would be good if customers with an address not in a VAT country should not be prompted for VAT. For example, I live in the US and if I go to purchase a product from my own store then I have a VAT input box that I need to read through to understand.

It is my understanding that doing business with EU countries requires VAT. If that is true then I don't want to disable it so I can comply with applicable laws. What would be helpful is when the customer enters an address where VAT does not apply then VAT is hidden from that customer.You can disable the VAT system via the AdminCP, if you don’t need it.

Am I taking crazy pills or wasn't there a follow-up post to this where you listed the different permutations and whether it functions the way you'd expect?It is my understanding that doing business with EU countries requires VAT. If that is true then I don't want to disable it so I can comply with applicable laws. What would be helpful is when the customer enters an address where VAT does not apply then VAT is hidden from that customer.

You are not crazy but I kept digging and found some more I wanted to include.Am I taking crazy pills or wasn't there a follow-up post to this where you listed the different permutations and whether it functions the way you'd expect?

I was just sitting down to start work based on that matrix and now it's gone

Does the US not have any way of either avoiding paying the sales tax by being a tax registered business or needing to show their tax registration ID to reverse charge (reclaim) the tax later?You are not crazy but I kept digging and found some more I wanted to include.

When selecting business there are 3 different potential outcomes.

1) Enable sales tax NOT checked: No Sales Tax or VAT input displays

2) Enable sales tax IS checked and Enable VAT is unchecked: Sales tax ID input is displayed

3) Both Sales tax and VAT is enabled: VAT registration number input box is played

Scenario 1: Works as expected as no tax input is displayed

Scenario 2 and 3: Both the Sales tax ID and VAT registration number appear to be validating VAT numbers. If this is the intent then this box should always be hidden whenever a country that does not use VAT is selected.

For example, A business based in the United States might be tempted to enter their tax id into the box and it would always fail validation. If no input would ever be validated from the selected country then the box should be hidden. It is also a weird experience as it isn't typical for American companies to enter tax IDs when purchasing online.

This is going to get long and complicated...Does the US not have any way of either avoiding paying the sales tax by being a tax registered business or needing to show their tax registration ID to reverse charge (reclaim) the tax later?

Being European born and bred I do admit the software is primarily designed with EU/VAT digital purchases in mind, so any info would be appreciated

So there would never be an instance where an American customer would ever be able to fill out any kind of "Sales tax ID" field?TLDR; Sales taxes are State based and not Federal and thus no VAT type system exist.

In some states and counties they may but your system doesn’t currently have a way to charge tax correctly (when required) in the US. There are probably APIs to help with this.So there would never be an instance where an American customer would ever be able to fill out any kind of "Sales tax ID" field?

I might just introduce another sub-option in the Sales Tax setting for "Show 'Sales Tax ID' field" since I absolutely cannot be bothered to study every sales tax system in every country

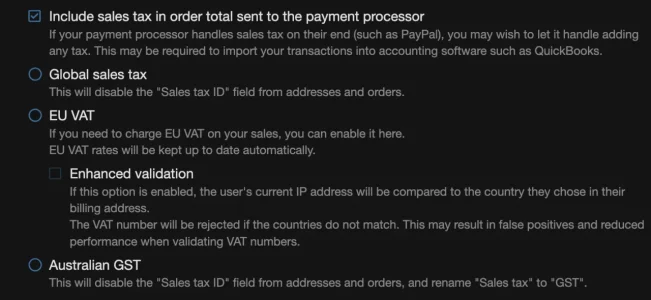

I'm going to go with this setup:In some states and counties they may but your system doesn’t currently have a way to charge tax correctly (when required) in the US. There are probably APIs to help with this.

I don’t foresee any American company needing to have their tax exempt number printed on an invoice unless it leads to no taxation.

is there an alternative to have Stripe or PayPal handle all the taxes and exemptions?I'm going to go with this setup:

View attachment 317385

Which I think will work the best, and will make it easier to add support for other tax systems in the future

Yeah, but usually customers get annoyed if the site says the price is €10 and then it turns out it's €12.50is there an alternative to have Stripe or PayPal handle all the taxes and exemptions?

Circling back to this; The "Sales tax ID" field was never shown on checkout (the final checkout page, not the address part of the checkout flow) if the order didn't contain VAT ("Enable VAT" was checked and the buyer's address' country had a sales tax rate set). Does that match with your experience as well?You are not crazy but I kept digging and found some more I wanted to include.

When selecting business there are 3 different potential outcomes.

1) Enable sales tax NOT checked: No Sales Tax or VAT input displays

2) Enable sales tax IS checked and Enable VAT is unchecked: Sales tax ID input is displayed

3) Both Sales tax and VAT is enabled: VAT registration number input box is played

Scenario 1: Works as expected as no tax input is displayed

Scenario 2 and 3: Both the Sales tax ID and VAT registration number appear to be validating VAT numbers. If this is the intent then this box should always be hidden whenever a country that does not use VAT is selected.

For example, A business based in the United States might be tempted to enter their tax id into the box and it would always fail validation. If no input would ever be validated from the selected country then the box should be hidden. It is also a weird experience as it isn't typical for American companies to enter tax IDs when purchasing online.

My experience is that if sales tax is enabled and vat is not then sales tax id shows but only validates valid VAT numbers.Circling back to this; The "Sales tax ID" field was never shown on checkout (the final checkout page, not the address part of the checkout flow) if the order didn't contain VAT ("Enable VAT" was checked and the buyer's address' country had a sales tax rate set). Does that match with your experience as well?

Address forms are intended to show the "Sales tax ID" input even if "Enable VAT" is disabled, but there was a bug that triggered the VAT ID validation and sent the address into the moderation queue if the relevant permission wasn't found, even if "Enable VAT" was disabled. These bugs should be fixed with the next version.

We use essential cookies to make this site work, and optional cookies to enhance your experience.