erich37

Well-known member

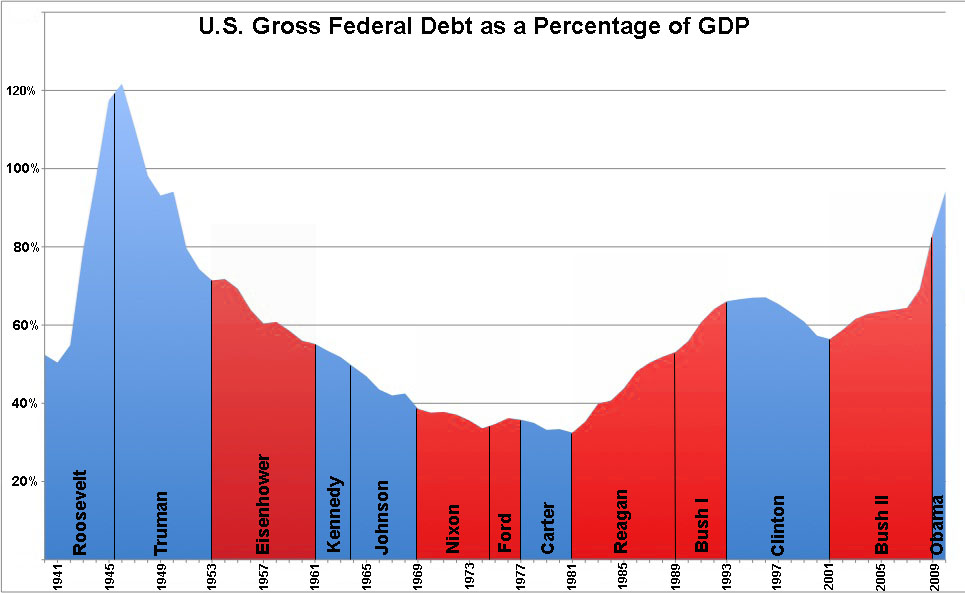

Third, thanks to the debt limit increase and a new round of borrowing our national debt now exceeds 100% of GDP.

US debt is currently at 600% of GDP.

Third, thanks to the debt limit increase and a new round of borrowing our national debt now exceeds 100% of GDP.

Got any figures to back that statement up, all the figures I've seen are nearing 100%. If it was 600%, things would definitely be a damn sight worse for the US than they already are.US debt is currently at 600% of GDP.

Got any figures to back that statement up, all the figures I've seen are nearing 100%. If it was 600%, things would definitely be a damn sight worse for the US than they already are.

If you add in federal government's $61.6 trillion in unfunded obligations for social security, medicare, etc. that aren't normally counted as part of the debt, that 600% percent of GDP figure is certainly plausible.Got any figures to back that statement up, all the figures I've seen are nearing 100%. If it was 600%, things would definitely be a damn sight worse for the US than they already are.

If you add in federal government's $61.6 trillion in unfunded obligations for social security, medicare, etc. that aren't normally counted as part of the debt, that 600% percent of GDP figure is certainly plausible.

A few other related links:

Is the Department of Department Departmentalization listed there.

US debt is currently at 600% of GDP.

Currently the Dow is down over 300 points today. I am hemorrhaging money from my 401A account. Anyone who thinks the US economy isn't teetering on the brink needs to remove their head from the sand and take a long hard look around. Individually, we all need to be storing food stocks and seed and buying whatever amounts of precious metals we can afford.

Currently the Dow is down over 300 points today...

Down 512 now...Make it 440...

Edit: 456 ATM

Yup, officially a "correction"... It's ugly the broader markets are just as bad the DJIA, NASDAQ, S&P 500 & NYSE Composite all ended the day down roughly 5%.Down 512 now...

Geez, this chart is vastly different than the one I saw in the economics class.

A couple interesting little factoids: during his 8 year tenure as Speaker of the House Dennis Hastert added roughly $3.1 trillion to the debt. By contrast Nancy Pelosi added roughly $5 trillion to the debt during her 4 year tenure as speaker.Take a closer look at the short period of time Obama has been in office and the drastic rise...that is not by coincidence nor is it "not really his fault". He is spending more and faster than any president in this country's history. Clinton's time reducing the debt coincides with the first Republican Congress in 40 years that put the breaks on spending during those years...if only they would have remained true to the task and held Bush W in check.

You may be accurate, but here is how I interrupt this: 1776 - 1990, $3 trillion in debt; Republicans - 8 years to add another $3 trillion; Democrats, 4 years to add more than $3 trillion; Obama - 18 months to add $3 trillion...A couple interesting little factoids: during his 8 year tenure as Speaker of the House Dennis Hastert added roughly $3.1 trillion to the debt. By contrast Nancy Pelosi added roughly $5 trillion to the debt during her 4 year tenure as speaker.

Source: http://www.cnsnews.com/news/article/debt-has-increased-5-trillion-speaker-pe

Second "It took from 1776, when the United States became an independent country, until 1990, the year after the Berlin Wall fell signaling victory in the Cold War, for the federal government to accumulate a total of $3 trillion in debt, according to the Treasury Department. It only took from Jan. 20, 2009, the day President Barack Obama was inaugurated, until Oct. 15, 2010, for the Obama administration to add $3 trillion to the federal debt."

Source: http://www.cnsnews.com/news/article/it-s-official-obama-has-now-borrowed-3-t

We use essential cookies to make this site work, and optional cookies to enhance your experience.