How are you handling sales of your add on?Regarding this:

User upgrades don't involve an email sent by the site. The only email involved is the receipt/transaction email sent by PayPal, but that doesn't relate to any form of link to the "online content". The software just automatically upgrades the account.

So that being the case, I'm just going to ignore this ridiculous bit of legislation as far as user upgrades are concerned.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

User upgrades and new EU VAT regulation re: digital services

- Thread starter Mr Lucky

- Start date

If I keep using XPM will this plan make me able to safely ignore the new legislation?I currently do it manually.

I was going to switch to using Chris' XPM in the new year.

Not any longer...

- Remove the ability to download the licenses from the site

- Click a button next to each license which sends an email with the add on as an attachment

Or do I need to literally open my email client, type their email addresses one by one and send it that way?

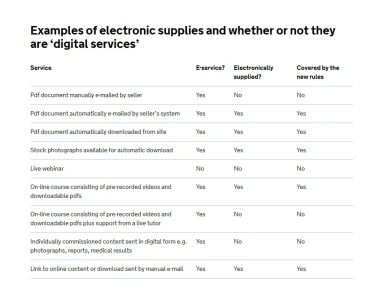

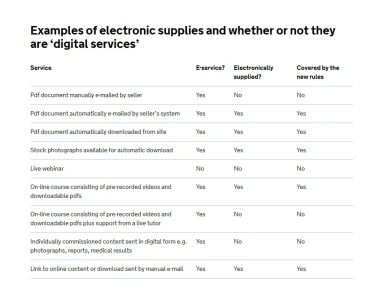

I'm no expert but I think that may be OK and avoid falling foul of the "Link to online content or download sent by manual e-mail" rule.

It's just ridiculous that you can manually email the content but not manually email a link to the content.

It's just ridiculous that you can manually email the content but not manually email a link to the content.

I'm going to consult an accountant and/or lawyer for sure. I'm just trying to make sense of this, it seems incredibly stupid. With how little sense it makes I also have to question what degree of manaul work makes it a "manual email".I'm no expert but I think that may be OK and avoid falling foul of the "Link to online content or download sent by manual e-mail" rule.

It's just ridiculous that you can manually email the content but not manually email a link to the content.

I would note that if you have any concerns as to whether you're affected, you would really need to contact your local tax authority to seek clarification for your specific circumstances. (There are things on the HMRC site that say a simple email in an otherwise automated process is affected but then they say somewhat different things elsewhere.)

Indeed.

It's not clear at all what is and isn't affected and I highly suspect that most people who work for HMRC won't be able to give definitive answers in some cases.

Clearly they are trying to target big businesses, due to their use of "automated emails", etc. but in doing so they have swept up everyone else who uses services such as FetchApp, XPM, etc.

I doubt they even considered forums and account upgrades when they were in the "planning" stage.

It's not clear at all what is and isn't affected and I highly suspect that most people who work for HMRC won't be able to give definitive answers in some cases.

Clearly they are trying to target big businesses, due to their use of "automated emails", etc. but in doing so they have swept up everyone else who uses services such as FetchApp, XPM, etc.

I doubt they even considered forums and account upgrades when they were in the "planning" stage.

What happens if the content can't be emailed as an attachment?

Say it's too big or contains a file type that some email providers wont accept.

For example I tried to send a zip file to myself earlier today containing an exe file only to be told by Google I can no longer do this. So I sent myself a dropbox link instead.

Would that constitute a download link and therefore fall under this legislation, just because google wouldn't let me email it?

If the file is a 30mb zip file and you can't attach it to an email you have to send a download link to each client. According to the last line of Russ' post that would be covered by this new legislation. This could also have an impact on graphic designers and photographers that create digital content, especially those that produce large files.

Say it's too big or contains a file type that some email providers wont accept.

For example I tried to send a zip file to myself earlier today containing an exe file only to be told by Google I can no longer do this. So I sent myself a dropbox link instead.

Would that constitute a download link and therefore fall under this legislation, just because google wouldn't let me email it?

If the file is a 30mb zip file and you can't attach it to an email you have to send a download link to each client. According to the last line of Russ' post that would be covered by this new legislation. This could also have an impact on graphic designers and photographers that create digital content, especially those that produce large files.

Carlos

Well-known member

Same way PayPal applies a "tax" of sorts on every purchase you make. (That is, if you don't put your checking account on their service.)I'm confused as to how another country can force a tax on me? Are we sure this affects companies and people in the US with assets strictly in the US?

Apparently so.So I sent myself a dropbox link instead.

Would that constitute a download link and therefore fall under this legislation, just because google wouldn't let me email it?

That's absolutely irrelevant. I understand how a site can force me to pay a fee to use their service. I don't understand how a country I don't live in and have no assets in can force me to collect taxes for them. How are these comparable?

Carlos

Well-known member

Because you used a service there, done business with that service there.That's absolutely irrelevant. I understand how a site can force me to pay a fee to use their service. I don't understand how a country I don't live in and have no assets in can force me to collect taxes for them. How are these comparable?

Example: Let's say PayPal is Headquartered in UK, and you live in United States. You bought something from someone else on PayPal, and he's from, say... China. YOU are taxed because you did business in UK.

That's why, if you're going to use a processor, use [a processor] in the home turf in which YOU live in.

It's the same thing being done with corporations who run their business in X state, but operate another business in X state.

Because you used a service there, done business with that service there.

Example: Let's say PayPal is Headquartered in UK, and you live in United States. You bought something from someone else on PayPal, and he's from, say... China. YOU are taxed because you did business in UK.

That's why, if you're going to use a processor, use [a processor] in the home turf in which YOU live in.

Carlos, that doesn't matter. Even if I had a payment processor based out of TX, USA, I lived in TX USA, but my customer was in the UK I technically would have to charge him this VAT then pay them what I've collected quarterly.

Carlos

Well-known member

Hm. I see. Well, the same principle applies. Because you're still taking business from someone in another "turf." (UK)Carlos, that doesn't matter. Even if I had a payment processor based out of TX, USA, I lived in TX USA, but my customer was in the UK I technically would have to charge him this VAT then pay them what I've collected quarterly.

Hm. I see. Well, the same principle applies. Because you're still taking business from someone in another "turf."

How am I "taking business" from anyone in the UK? Because they're not spending the money they gave me for a product there?

Carlos

Well-known member

You're making money from that individual in there. That's all I was saying. I'm not saying you're stealing or whatever, just that you're selling to that person in that area.How am I "taking business" from anyone in the UK? Because they're not spending the money they gave me for a product there?

Governments don't care where you're from. That's the gist here.

A site charging me a fee for using their service != a country enforcing their legistlation on me. I don't care which words you bold, the two things are not comparable.

Let's get back on topic though.

Let's get back on topic though.

Carlos

Well-known member

A site charging me a fee for using their service != a country enforcing their legistlation on me. I don't care which words you bold, the two things are not comparable.

Let's get back on topic though.

The fact of the matter is most larger online retailers have a presence in the EU and that's why they are required to pay VAT on sales.

I highly doubt small US based businesses will be required to collect VAT. Heck, they don't even have to collect sales tax for other states in most cases. So collecting for the EU would be out of the question and unenforceable.

I highly doubt small US based businesses will be required to collect VAT. Heck, they don't even have to collect sales tax for other states in most cases. So collecting for the EU would be out of the question and unenforceable.

Similar threads

- Replies

- 8

- Views

- 1K

- Replies

- 4

- Views

- 3K