Mr Lucky

Well-known member

I would like to know if you sell user upgrades, does this count as a digital service? According to my accountant, a user upgrade that is charged for will count as a digital service (more forum features) is offered.

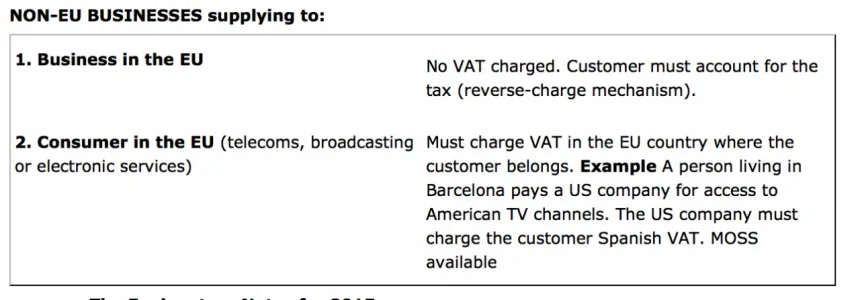

If so then there would be serious repercussions under the new EU VAT laws, whereby VAT is applicable in the country of the customer, not the seller.

So even if you are below the UK threshold of £81,000 you still have to charge and account for VAT in countries such as France and Greece for any digital download or service provided.

http://www.theguardian.com/small-business-network/2014/dec/08/new-vat-regulations-affect-smes

My understanding is this will affect people and companies in all countries selling digital services, not just the EU, so US companies such as EastWestSound are offering last minute big discounts before they, as a US company, have to start charging VAT for EU customers.

https://www.facebook.com/eastwestsound

If so then there would be serious repercussions under the new EU VAT laws, whereby VAT is applicable in the country of the customer, not the seller.

So even if you are below the UK threshold of £81,000 you still have to charge and account for VAT in countries such as France and Greece for any digital download or service provided.

http://www.theguardian.com/small-business-network/2014/dec/08/new-vat-regulations-affect-smes

My understanding is this will affect people and companies in all countries selling digital services, not just the EU, so US companies such as EastWestSound are offering last minute big discounts before they, as a US company, have to start charging VAT for EU customers.

https://www.facebook.com/eastwestsound